The debtor either has significant equity in their house (normally at least 50% of the residential or commercial property's value) or has actually paid it off totally. The customer chooses they require the liquidity that comes with getting rid of equity from their home, so they work with a reverse mortgage therapist to discover a lending institution and a program.

The lending institution does a credit check, examines the borrower's property, its title and assessed worth. If authorized, the lending institution funds the loan, with earnings structured as either a swelling amount, a credit line or routine annuity payments (monthly, quarterly or every year, for instance), depending upon what the borrower picks.

Some loans have limitations on how the funds can be used (such as for improvements or remodellings), while others are unrestricted. These loans last till the debtor passes away or moves, at which time they (or their heirs) can pay back the loan, or the home can be sold to repay the lending institution.

In order to receive a government-sponsored reverse home loan, the youngest owner of a house being mortgaged must be at least 62 years of ages. Borrowers can only obtain against their primary house and needs to likewise either own their residential or commercial property outright or have at least 50% equity with, at many, one main lienin other words, debtors can't have a second lien from something like a HELOC or a second mortgage.

Typically just certain kinds of residential call westlake financial or commercial properties receive government-backed reverse home mortgages. Qualified homes include: Single-family homes Multi-unit homes with up to four units Manufactured homes built after June 1976 Condos or townhouses In the case of government-sponsored reverse home loans, debtors also are required to endure a details session with an approved reverse home loan counselor.

Private reverse mortgages have their own qualification requirements that differ by loan provider and loan program. If you get a proprietary reverse mortgage, there are no set limitations on just how much you can obtain. All limits and restrictions are set by individual loan providers. Nevertheless, when utilizing a government-backed reverse mortgage program, house owners are restricted from borrowing approximately their home's evaluated value or the FHA optimum claim quantity ($ 765,600).

Part of the home's worth is utilized to collateralize loan costs, and lenders likewise typically demand a buffer in case property values decline. Borrowing limits likewise adjust based on the customer's age and credit and likewise the loan's interest rate. There are two primary expenses for government-backed reverse home loans: These might be repaired if you take a swelling sum (with rates starting under 3.5% a rate similar to traditional home loans and much lower than other house equity loan items).

Top Guidelines Of What Is An Underwriter In Mortgages

Federally backed reverse mortgages have a 2% in advance home mortgage insurance coverage premium and yearly premiums of 0.5%. Mortgage insurance coverage is implied to safeguard lending institutions in case of debtor default. While reverse home mortgages can't generally default in the same methods as traditional mortgageswhen customers fail to make paymentsthey can still default when owners stop working to pay real estate tax or insurance coverage or by failing to correctly maintain their residential or commercial properties.

Lenders likewise usually charge other fees, including for property appraisals, servicing/administering loans and other closing expenses, such as credit check costs. However, all expenses are usually rolled into the balance of the home loan, so loan providers don't need to pay them expense. A lot of reverse mortgages are government-insured loans. Like other government loans, like USDA or FHA loans, these products have guidelines that traditional home mortgages don't have, because they're government-insured.

There are also private reverse mortgages, which do not have the very same strict eligibility requirements or financing requirements. Single-purpose loans are generally the least pricey type of reverse mortgage. These loans are supplied by nonprofits and state and city governments for particular purposes, which are determined by the loan provider. Loans may be attended to things like repair work or enhancements.

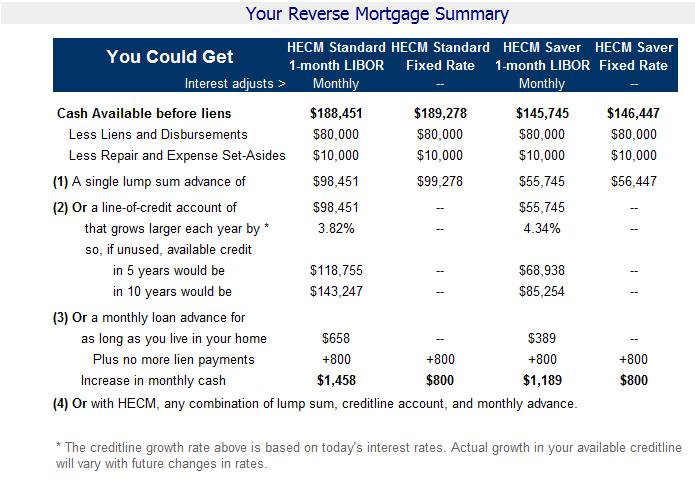

Home equity conversion mortgages (HECMs) are backed by the U.S. Department of Housing and Urban Development and can be more costly than conventional home mortgages. However, loan funds can be used for practically anything. Debtors can select to get their money in several different methods, including a swelling sum, fixed month-to-month payments, a line of credit or a mix of regular payments and credit line.

Lenders set their own eligibility requirements, rates, costs, terms and underwriting procedure. While these loans can be the easiest to get and the fastest to fund, they're also known to draw in dishonest experts who use reverse mortgages as an opportunity to fraud unsuspecting senior citizens out of their property's equity. Reverse mortgages aren't great for everybody.

A reverse home mortgage might make good sense for: Senior citizens who are encountering considerable expenses late in life People who have depleted the majority of their savings and have substantial equity in their main residences People who do not have heirs who care to acquire their home While there are some cases where reverse mortgages can be handy, there are great deals of reasons to avoid them (what are current interest rates on mortgages).

In fact, if you think you may plan to repay your loan completely, then you may be much better off preventing reverse mortgages altogether. However, http://chancekbsa808.trexgame.net/how-mortgages-payments-work-an-overview normally speaking, reverse home loans must be repaid when the borrower passes away, moves, or sells their house. At that time, the debtors (or their beneficiaries) can either repay the loan and keep the property or sell the home and utilize the earnings to repay the loan, with the sellers keeping any profits that remain after the loan is paid back.

Getting My What Percentage Of Mortgages Are Fha To Work

However a lot of the advertisements that consumers see are for reverse home mortgages from private companies (why do mortgage companies sell mortgages). When dealing with a private lenderor even a private business that claims to broker government loansit's cancel sirius xm radio crucial for debtors to be cautious. Here are some things to keep an eye out for, according to the FBI: Don't react to unsolicited mailers or other advertisements Don't sign documents if you do not comprehend themconsider having them reviewed by a lawyer Do not accept payment for a house you do not own Be careful of anybody who states you can get something for nothing (i.e., no deposit) In a lot of cases, these frauds get unwitting homeowners to take out reverse home mortgages and provide the cash to the fraudster.

Reverse mortgages aren't for everyone. In most cases, potential debtors might not even certify, for instance, if they aren't over 62 or do not have substantial equity in their homes. If a reverse mortgage isn't ideal for you, there are lots of other routes you can go to get the financing you require.

A reverse home loan is a home mortgage that you do not need to pay back for as long as you reside in your house. It can be paid to you in one lump sum, as a regular month-to-month earnings, or at the times and in the quantities you want. The loan and interest are paid back only when you offer your house, permanently move away, or die.

They are repaid in full when the last living borrower passes away, sells the house, or permanently moves away. Since you make no month-to-month payments, the quantity you owe grows bigger over time. By law, you can never ever owe more than your home's value at the time the loan is paid back.